27+ calculate dti for mortgage

Use NerdWallet Reviews To Research Lenders. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you.

Some High Dti Loans Could Be Qualified Mortgages After Patch Ends Crl National Mortgage News

Web On the one hand the math for calculating your DTI is simple we add up what your monthly debt will be once you have your new home such as student loans car.

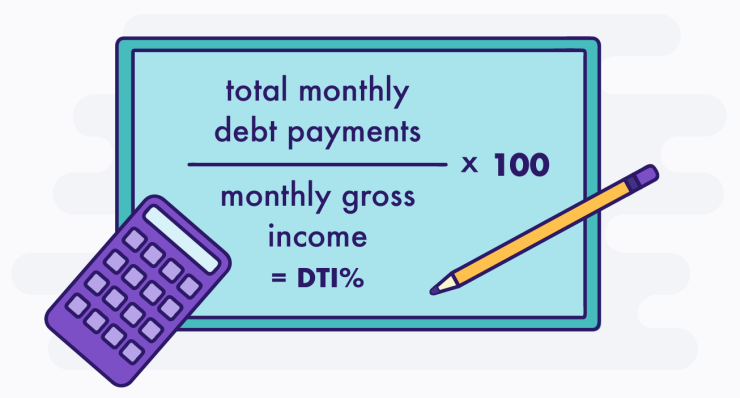

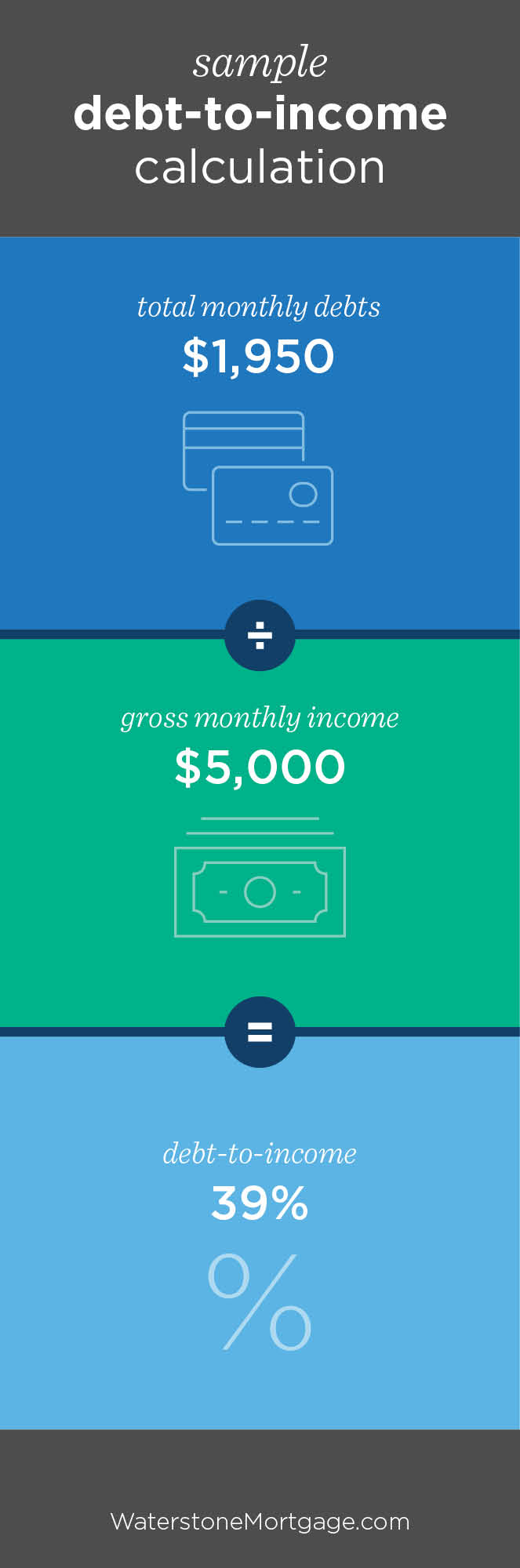

. Divide your total monthly debts as defined in Step 1 by your gross income as defined in Step 3. Thats your current debt-to-income ratio. Contact a Loan Specialist.

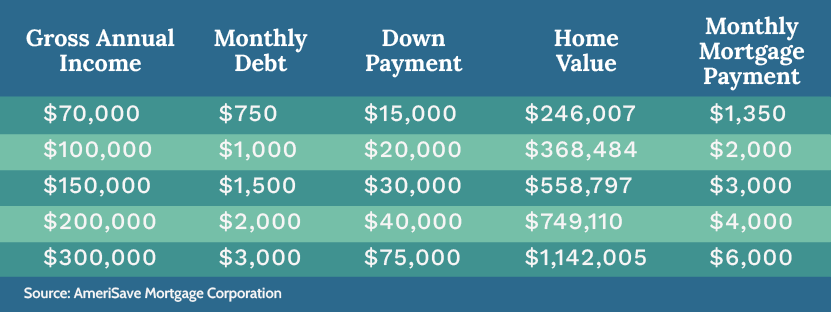

If your yearly income is 60000 and your total monthly debt. Only Takes Minutes to Get Preapproved with a VA Lender. Ad See how much house you can afford.

Take Advantage And Lock In A Great Rate. Estimate your monthly mortgage payment. Web Divide Step 1 by Step 3.

36 DTI or lower. Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. Web To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other regular.

The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income. Browse Information at NerdWallet. Web Your debt-to-income ratio matters when buying a house.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Web Debt-To-Income Ratio - DTI. Web The DTI Mortgage Calculator powered by GCA Mortgage Group will get you the front-end and back-end debt-to-income ratios on the different types of mortgage loan programs.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Only Takes Minutes to Get Preapproved with a VA Lender.

Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support. Web Debt-to-Income Ratio Calculator. Heres how lenders typically view DTI.

If your gross income for the month is 6000 your debt-to-income ratio would be 33 2000 6000 033. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. For example if your monthly pre-tax income is.

Ad Learn More About Mortgage Preapproval. VA Loan Expertise and Personal Service. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan.

Web It is calculated by adding the mortgage payment homeowners insurance real estate taxes and homeowners association fees and dividing that by the monthly. Divide your monthly debt obligations by your monthly income to get your DTI ratio. Web Your monthly debt payments would be as follows.

Get Your Quote Today.

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

How To Calculate Your Debt To Income Ratio And What It Means Mintlife Blog

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

Estimate Your Payment With Our Mortgage Calculator Austin Capital Mortgage

How To Lower Your Dti Ratio

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

How To Calculate Your Debt To Income Ratio Vero Mortgage

Calculate How Much You Can Afford Home Affordability Amerisave

How To Calculate A Debt To Income Ratio For A Mortgage Guild Mortgage

Debt To Income Dti Ratio Calculator 2023 Casaplorer

Debt To Income Ratio Dti Formula Calculator

How To Lower Your Mortgage Debt To Income Ratio Dti Better Mortgage

Debt To Income Ratio Calculator Nerdwallet

Debt To Income Ratio Calculator Ramsey

How To Calculate Your Debt To Income Ratio Step By Step Mymove

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator